Case Study —

Scaling payments & credit at Pleo

Pleo builds spend management tools that help companies in Europe process expenses and issue smart virtual and physical company cards to their employees.

( A )

At Pleo, I led design direction for the payments infrastructure which enabled Pleo’s customers in its 16 markets, from SEPA schemes in Europe to Bacs Direct Debit & Open Banking in the UK.

(B)

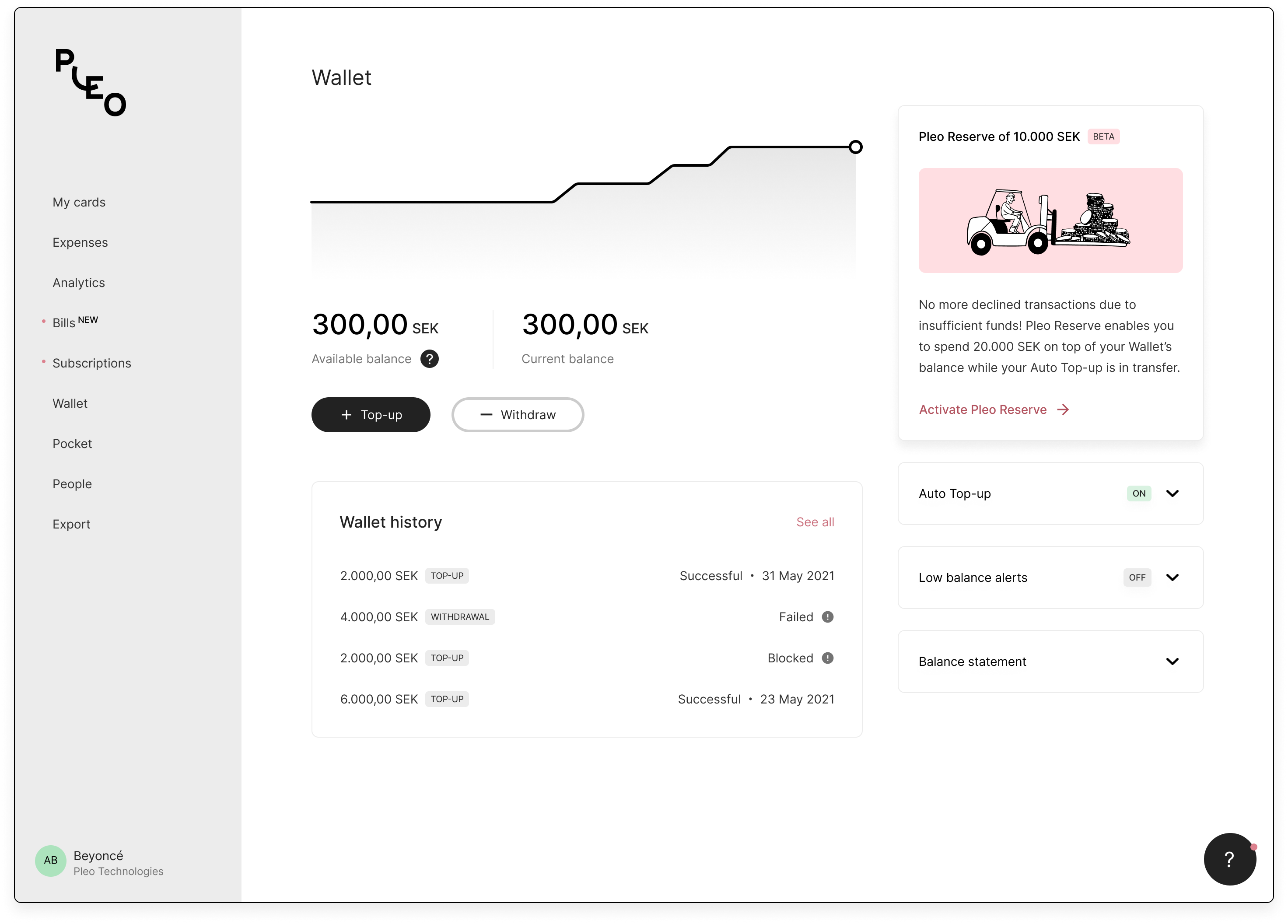

I led design efforts to drive key initiatives to reduce the number of transaction declines at Pleo which included redesigning the Pleo wallet and leading design efforts for Reserve, Pleo's flagship credit solution.

1 wallet. 16 countries.

The Pleo wallet is the financial control center for all companies using Pleo to manage spending and expenses. It's typically managed by admins that are required to add money to it in order to enable spending for invoices, card payments, and subscriptions. And in an increasingly complex, international, and fast-paced environment, companies today struggle to allocate their funds in the most efficient way.

The Pleo payments and credit teams primary objectives tie into making sure admins can get funds into Pleo and helping them spend efficiently.

Making it easy for Admins to quickly get funds into Pleo.

Transfer of funds typically involves long lead times and poor traceability which makes it a cumbersome process for Admins of companies using Pleo. To help our customers we build and integrate the fastest and most reliable banking rails available. This allows our customers to transfer funds quickly and with ease. In addition, we give visibility on transfers to give ease of mind. This reduces overhead and discomfort for Admins as well as reduced declined payments due to insufficient funds.

Over time, I led product discovery, management, and design to help Pleo integrate different rails to make this possible.

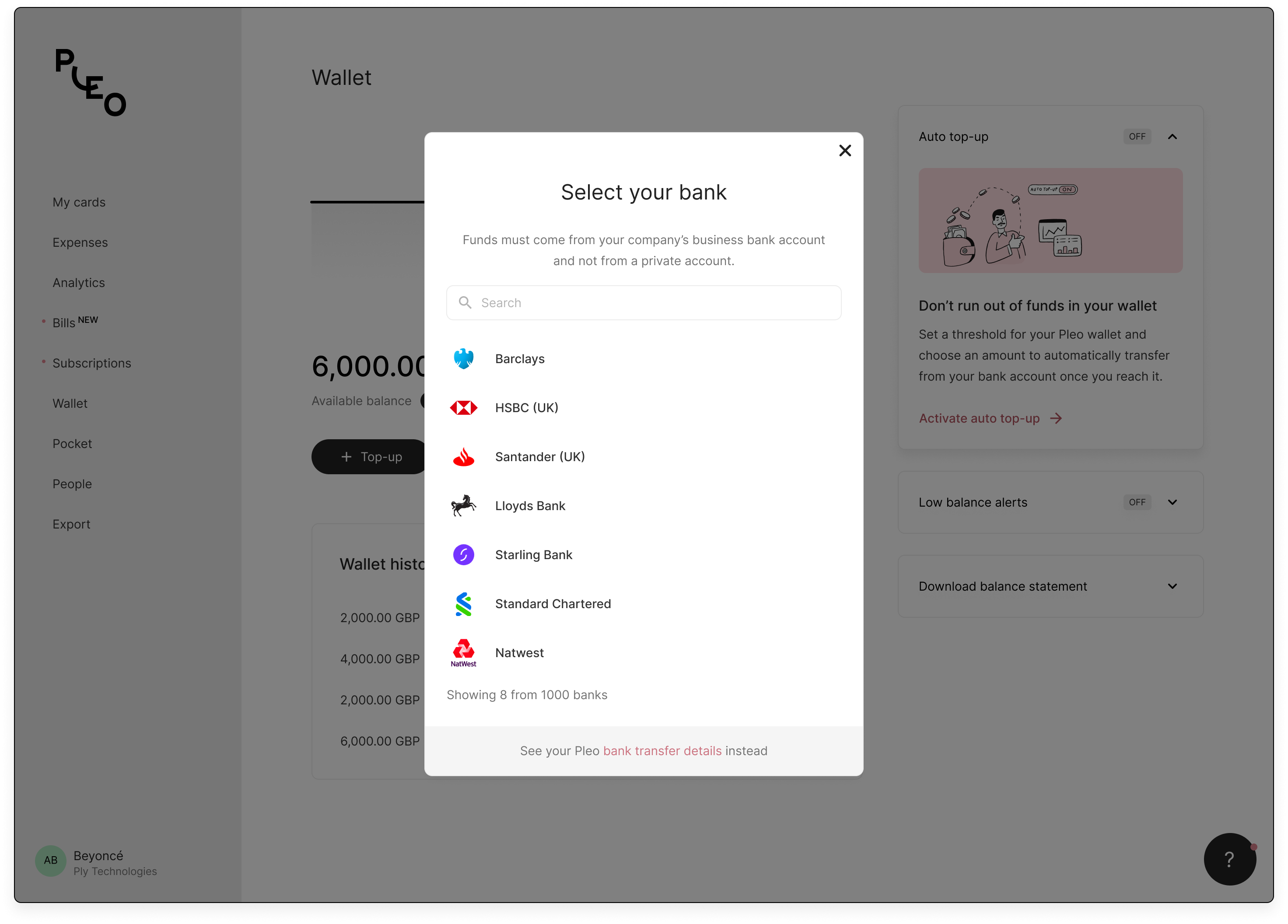

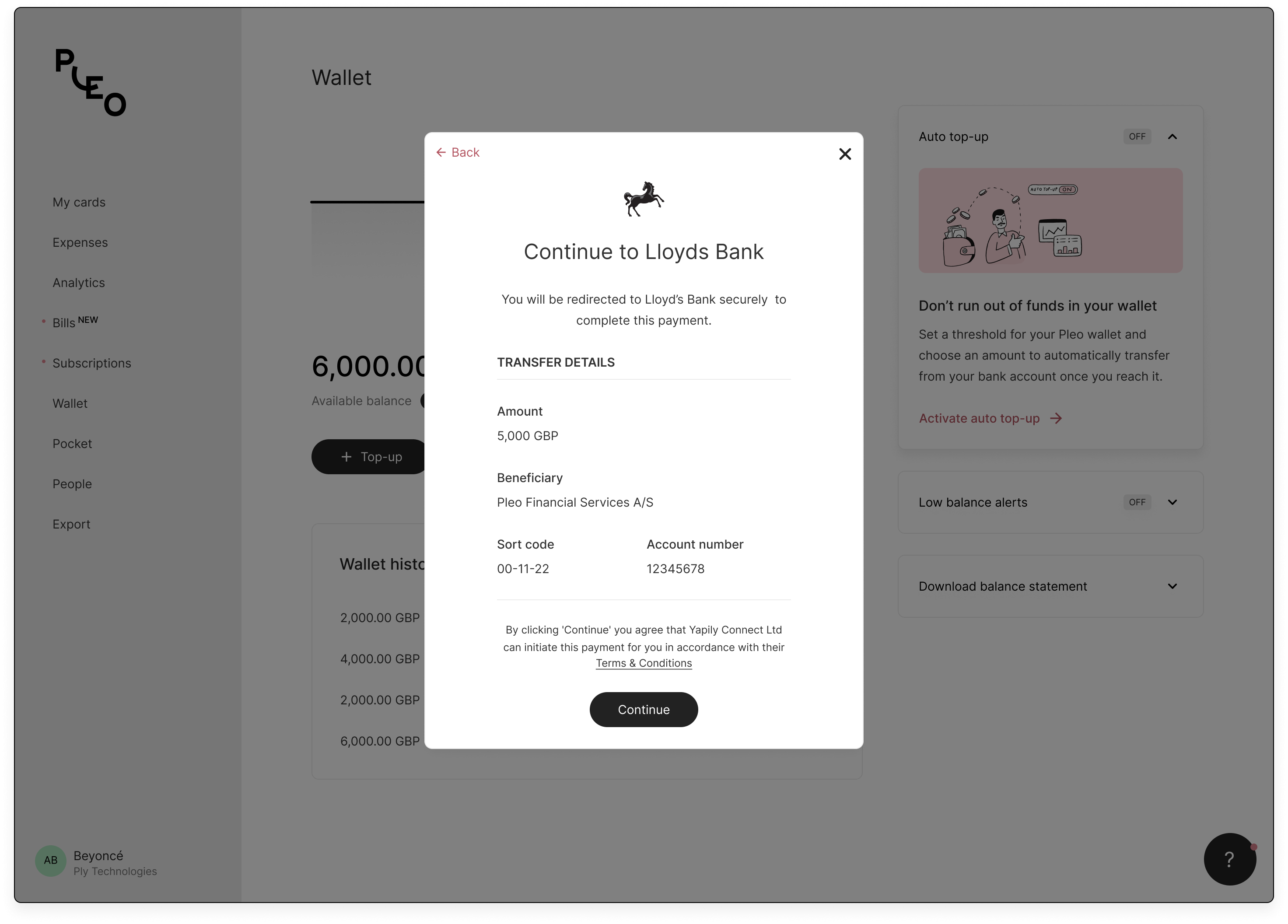

Open Banking in the UK and Europe

Bank Transfers are the typical method of funding wallets, but they have a couple of fundamental flaws - Financial organisations like Pleo can't track the flow of funds from a customer's banks account into their Pleo wallets, the experience of having to copy and paste bank details from the Pleo wallet into the several banking apps was lacking a certain finesse, converting users from onboarding to making their first wallet top-up was a terrible experience due to manual bank transfers.

With all these problems, we partnered with Yapily, Europe's largest Open Banking platform to build a personalised experience for Pleo's customers across the UK and Europe.

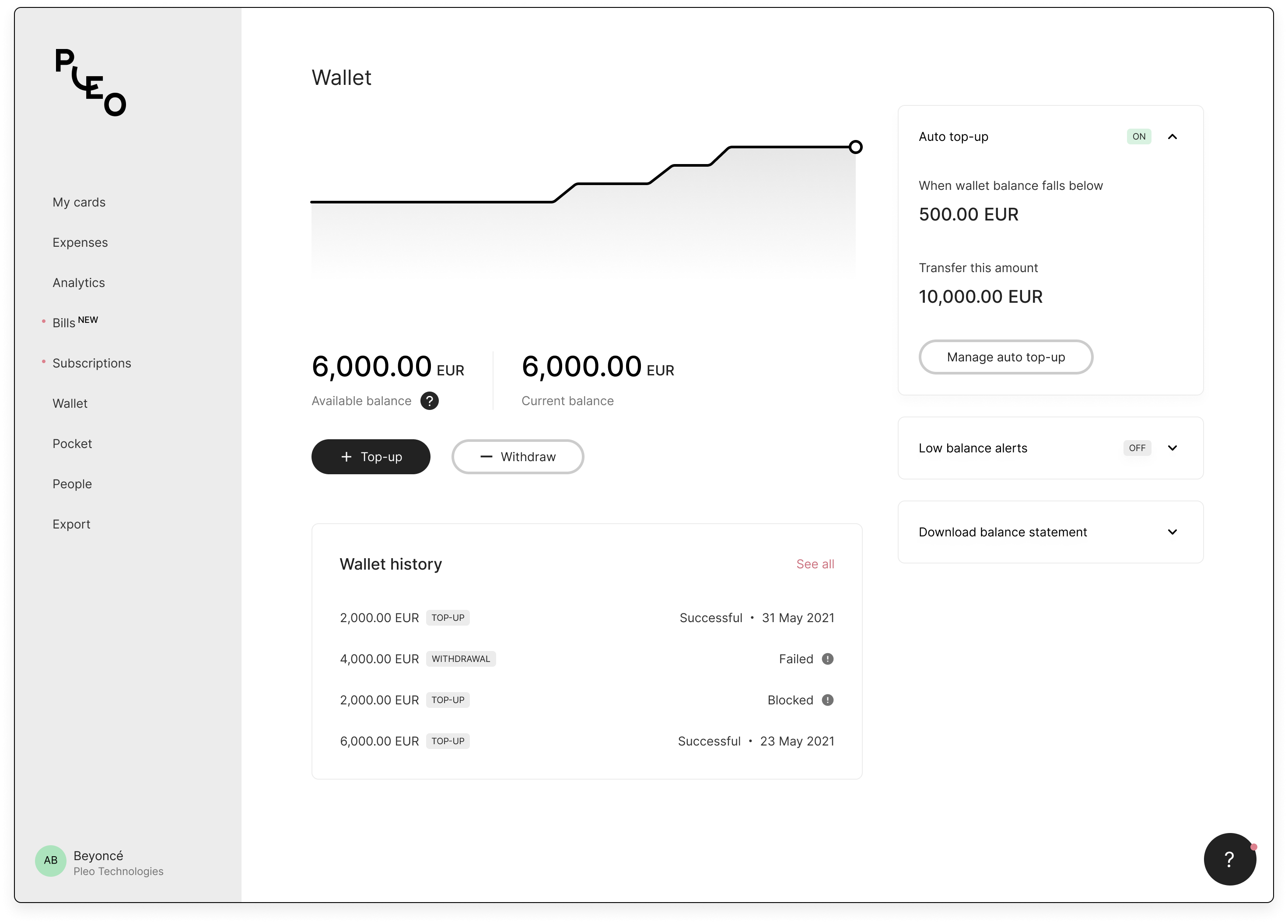

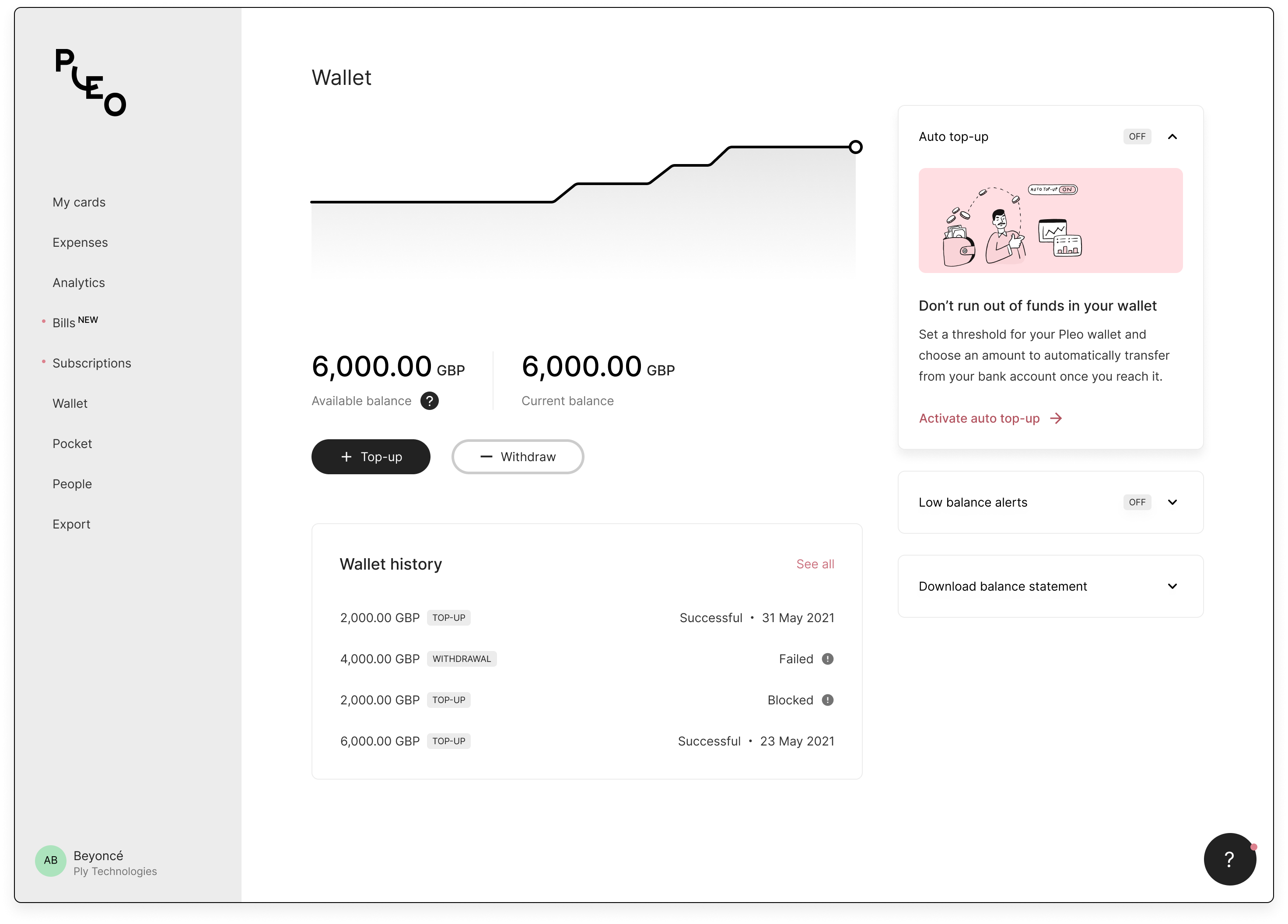

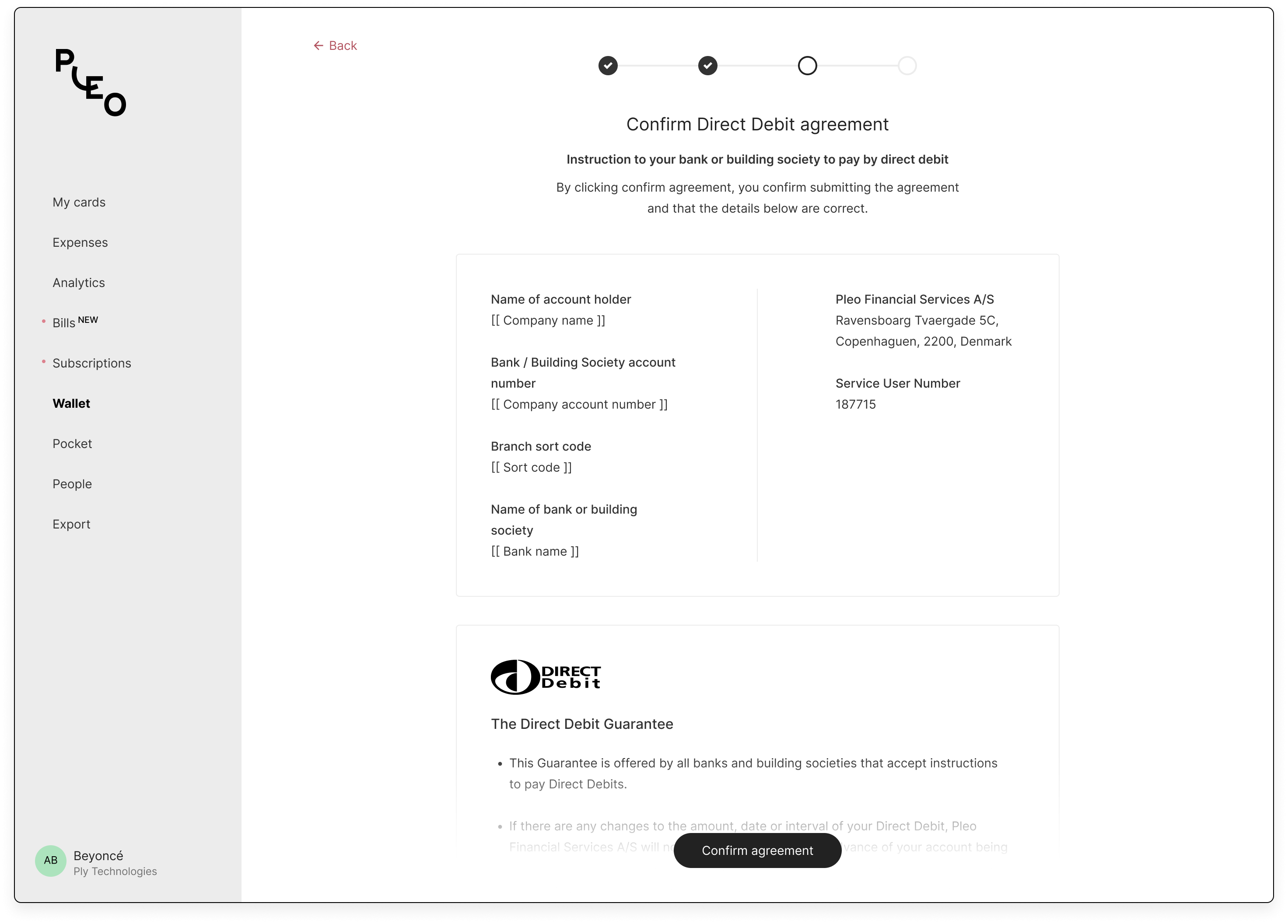

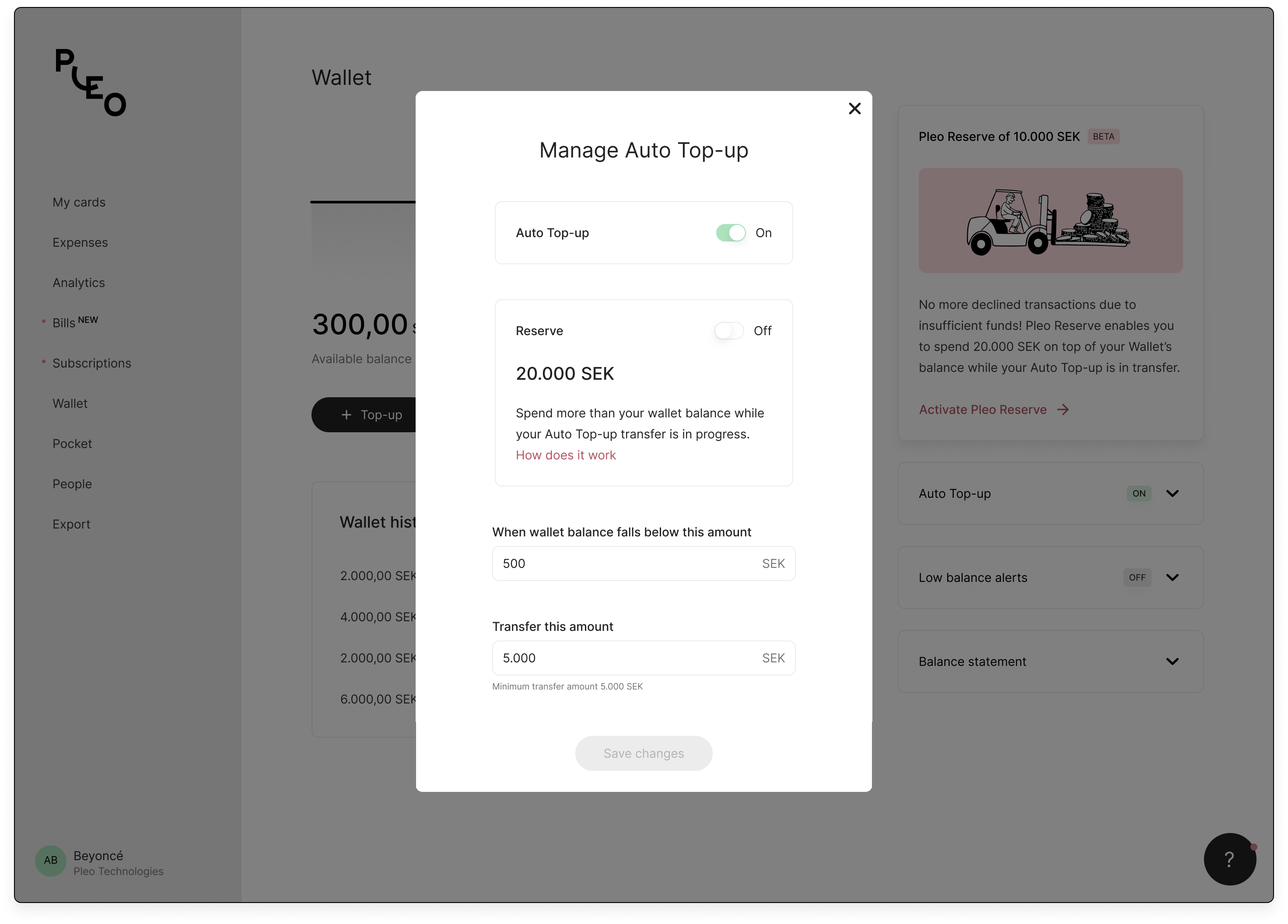

Direct Debit & Auto Top-up

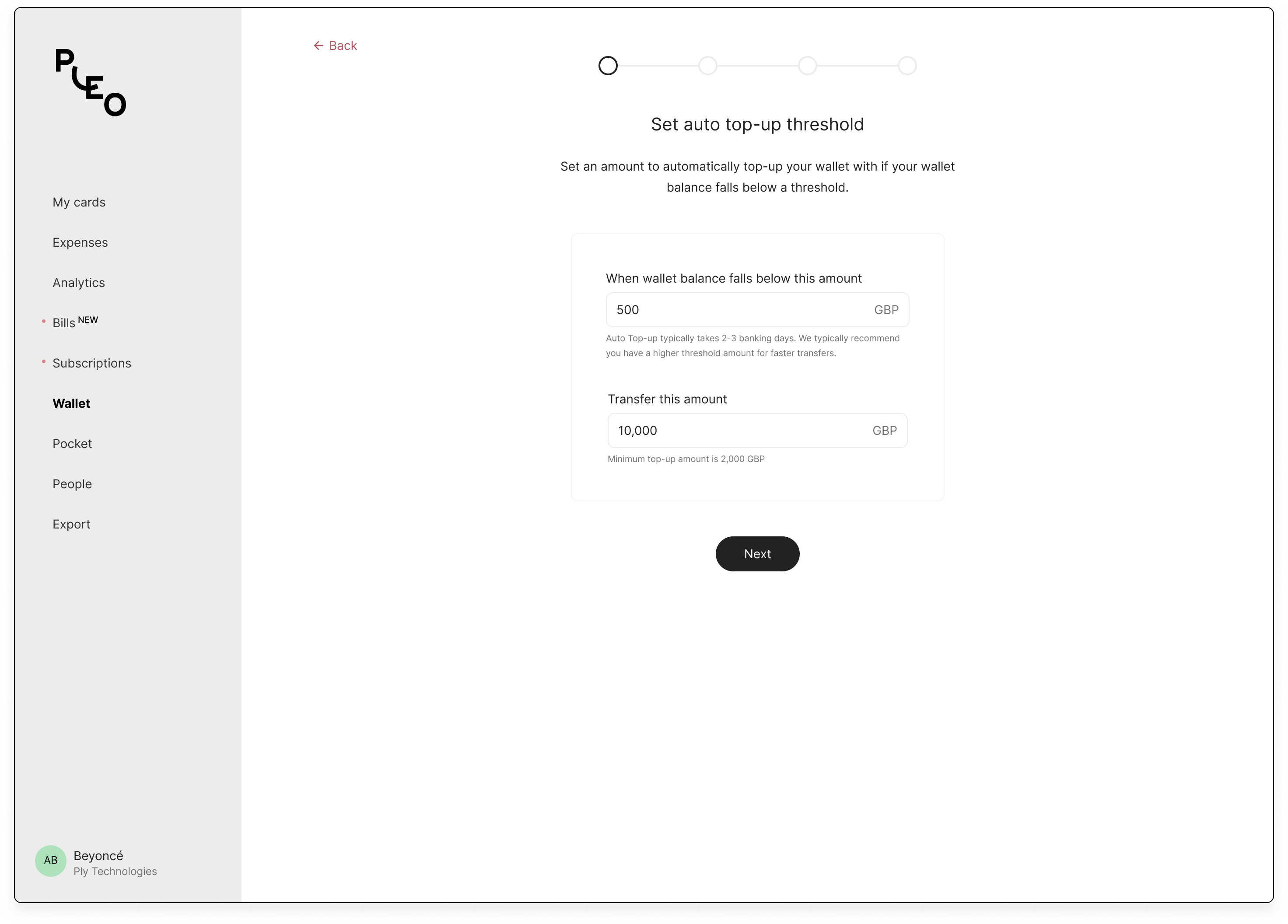

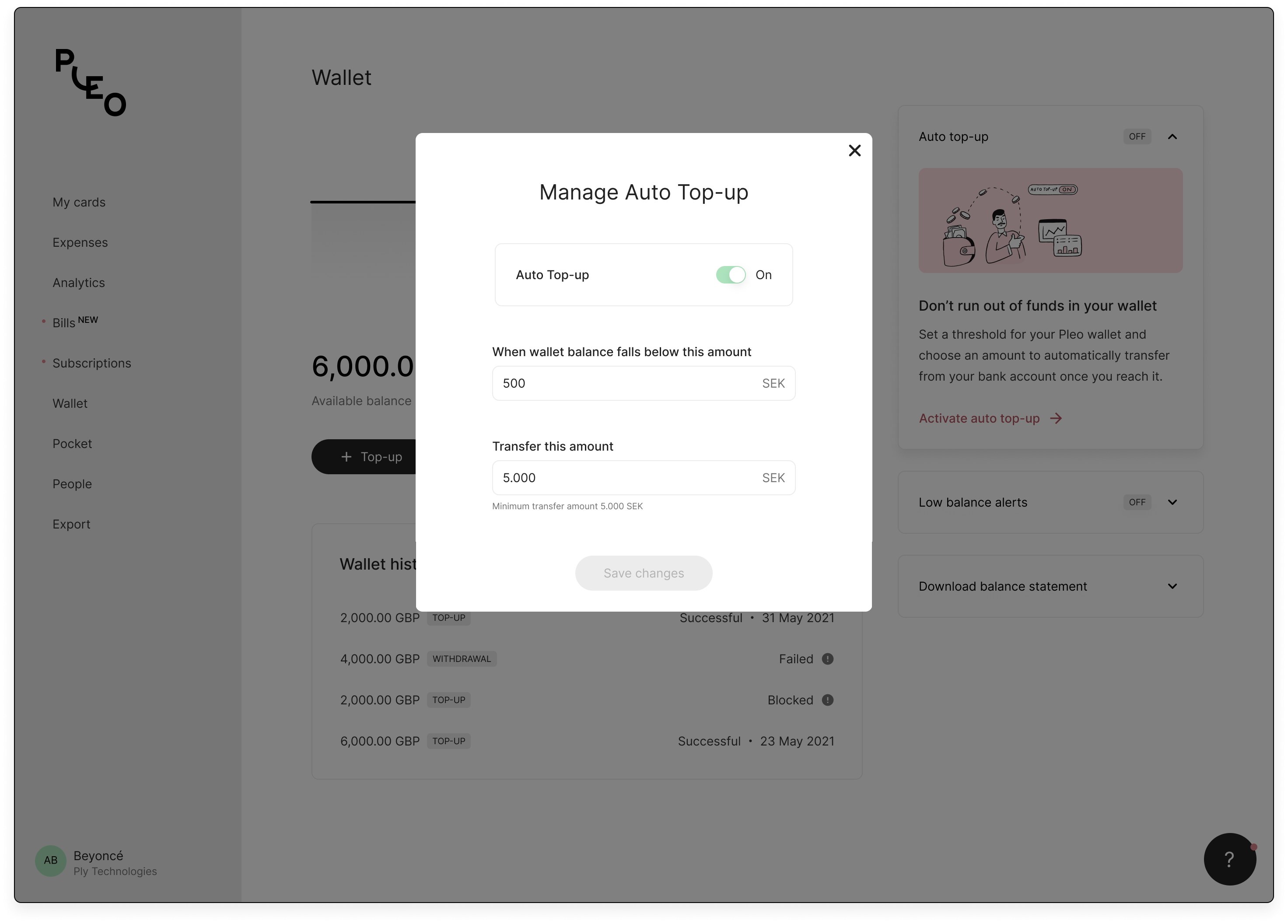

The one drawback with bank transfers in the Pleo wallet is that an admin always has to remember to make a transfer.

This is quite inefficient as it makes individuals single points of failure that can lead to business-critical transactions being declined due to a transfer not being made. We built Auto Top-up to mitigate this.

How does it work? When a customer's Pleo wallet reaches a set threshold amount, we trigger a direct debit to pull funds from the customer's bank account.

This product relied on Direct Debit integrations with Bacs in the UK, Autogiro in Sweden, Mastercard in Denmark, and SEPA across the rest of Europe. All of which I led designs and redesigns of.

How's it going?

Auto Top-up has been updated by over 45% of Pleo's companies in markets where it has been launched and has helped to reduce transactions declined due to insufficient funds.

The percentage of companies who experience declined transactions due to insufficient funds drops from ~20% pre-Auto Top-up enablement to ~15% post-Auto Top-up enablement.

The percentage of insufficient fund declines from companies who have enabled Auto Top-up drops from ~3.5% Pre-Auto Top-up enablement to ~1.1% post-Auto Top-up enablement.

Reducing declines due to insufficient funds.

A common problem faced by almost 50% of all our customers in the past 12 months is that a transaction gets declined due to insufficient funds on Pleo Wallet. We saw this problem present across all core markets: both through the admin survey and through the data on the declines due to insufficient funds.

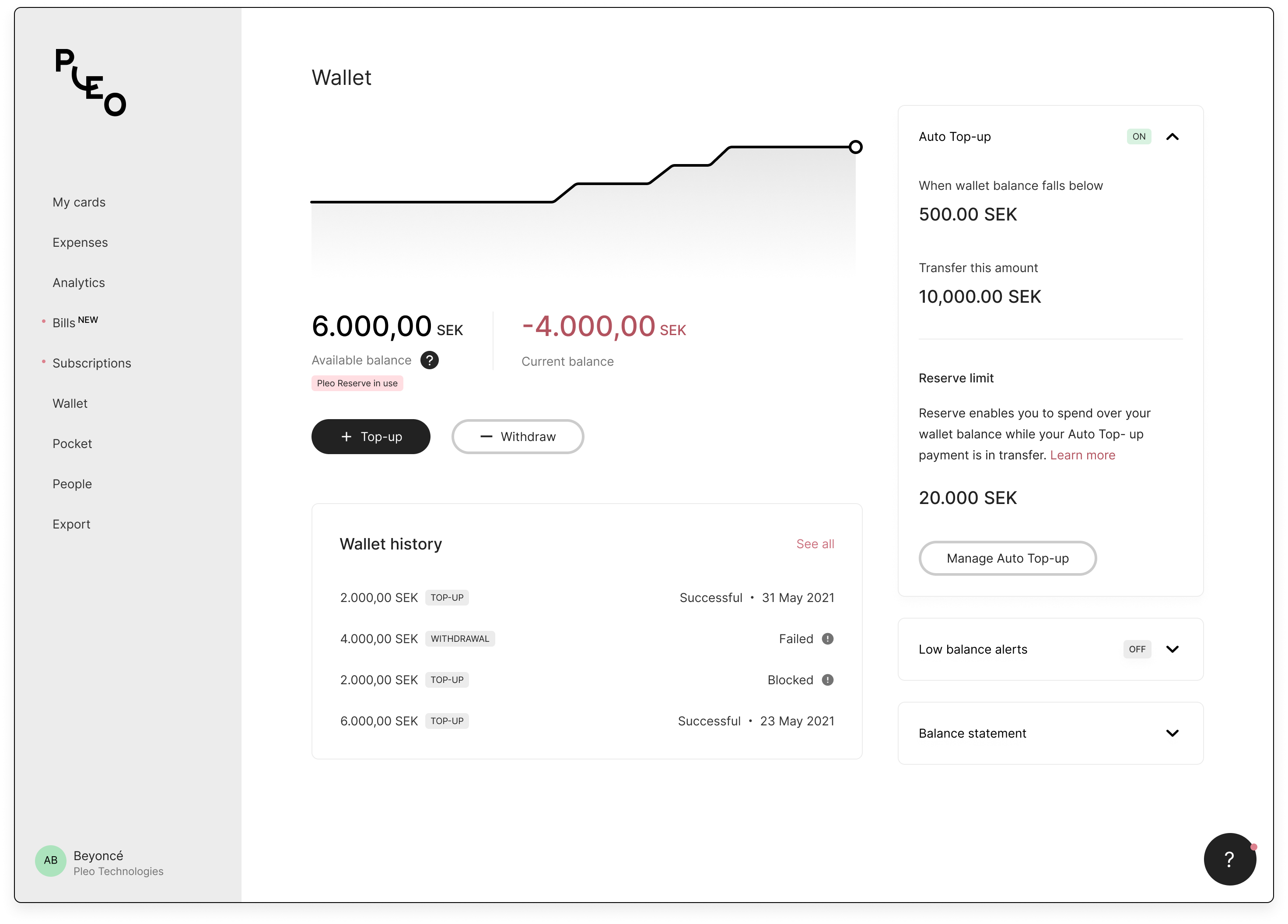

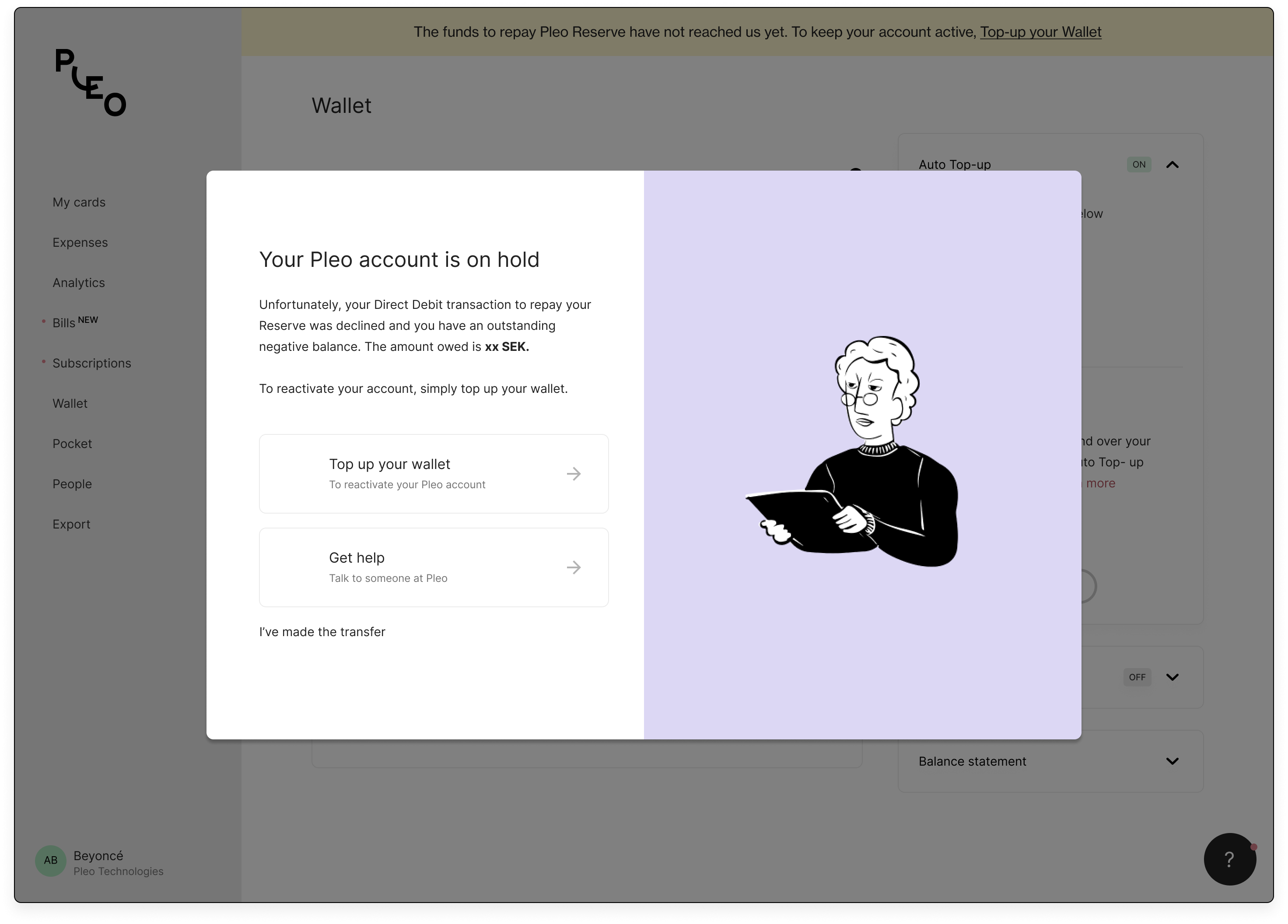

Customers experience a declined transaction due to insufficient funds and then they load the Pleo wallet as soon as possible. Enabling auto top-up reduces the amount of declined transactions due to insufficient funds to about 1%. Unfortunately, bank transfers initiated by auto top-up can take several days to arrive. In this case, the wallet may run out of funds and transactions would be declined until payment arrives in the wallet.

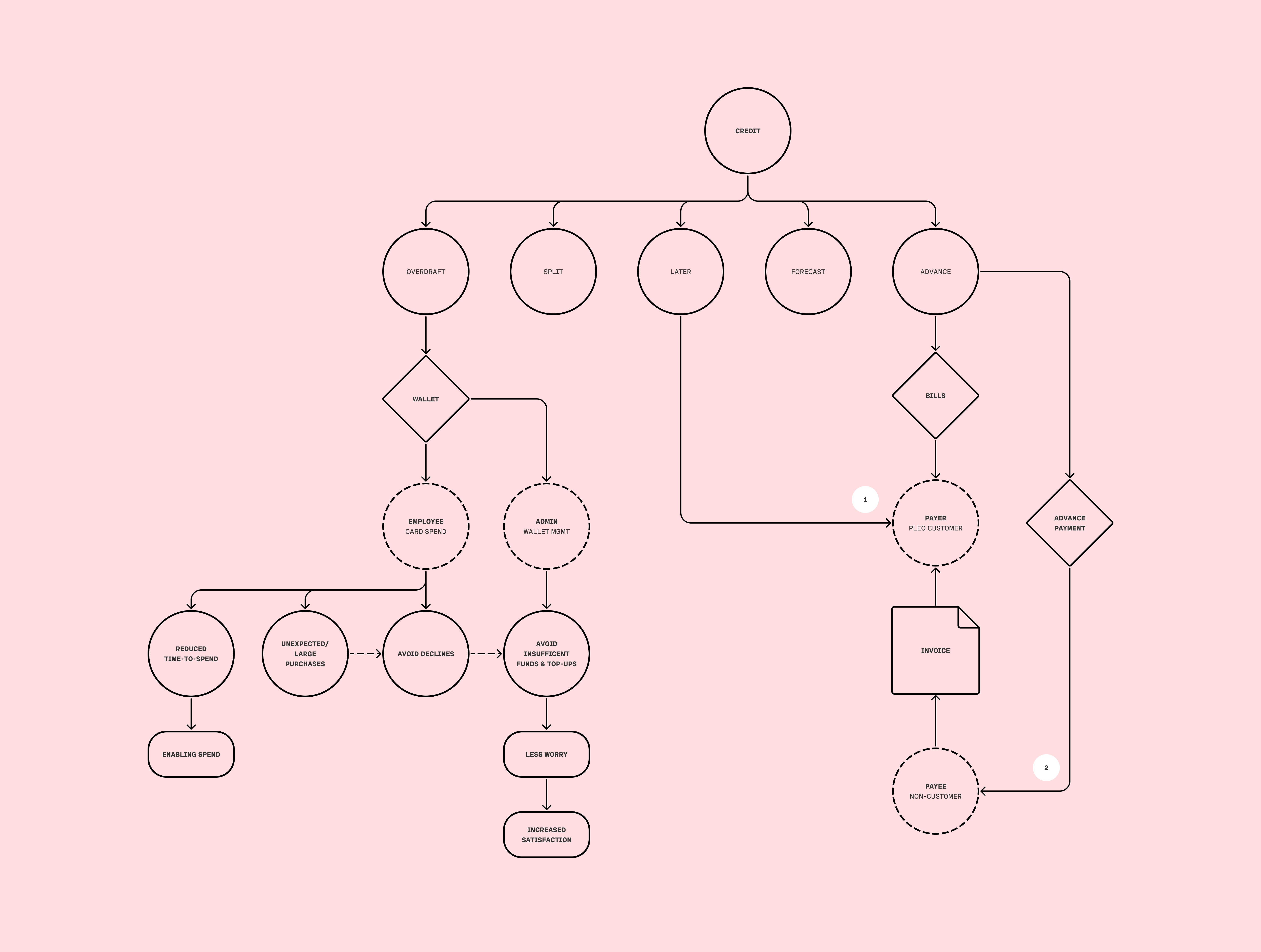

In order to improve the experience of wallet management for the customers and make them more comfortable to trust Pleo with all their expenses, we explored how Credit would fit in with Pleo's offering.

We at Pleo had a strong feeling that Credit would provide value to our customers & Pleo. But before we could define what Pleo's credit offering should be and how to (re)position Pleo - we needed to understand which problem(s) we should solve and which solutions did Pleo seem like a relevant provider to?

Along with a user research team, we sent out a credit survey invite to a random selection of 10,542 admins at FDD (Full due diligence) companies, across all markets and sizes.

Armed with core insights and outlined customer behavior and patterns from the survey, we set out on deeper interviews with customers which led us to understand the 2 fundamental problems companies faced.

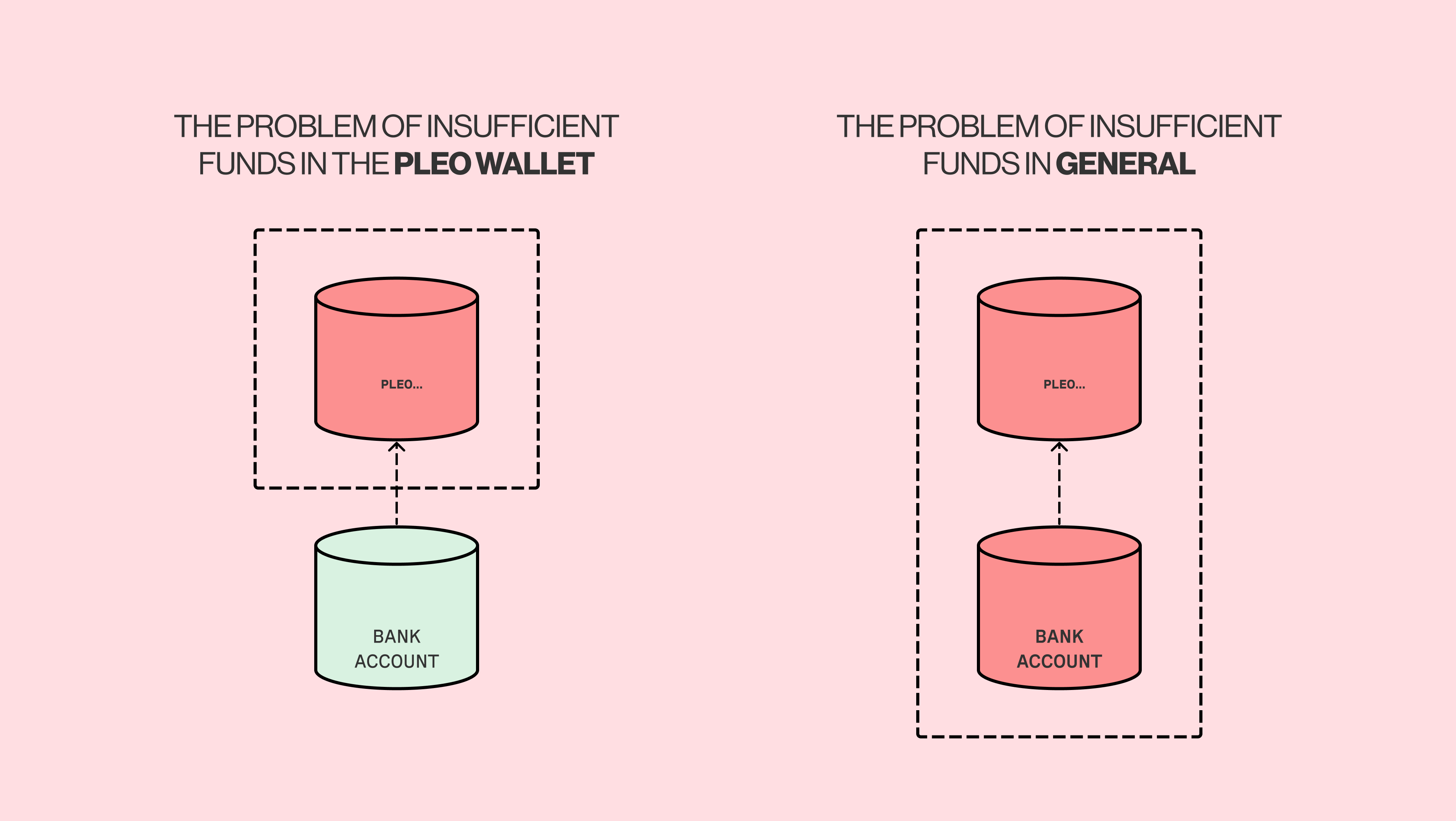

Insufficient funds in the Pleo Wallet.

This is essentially the problem of having to avoid declined transactions due to insufficient funds, which may be caused either by delayed top-ups, poor management, and projection, and lastly —weak cash flow and the inability to top-up enough for the budgeted spend through Pleo. This causes a fear of low balance among admins.

This also limits Pleo from growing from an expense solution to being the go-to Spend platform. This means that customers either need to transfer large sums to guarantee a smooth run (blocking cash flow, a big problem for SMBs). Or customers need to “predict” how much they might need to spend, then constantly monitor/boost it up (before it runs out, otherwise you get rejected), which makes their life hard and makes Pleo unreliable for bigger/critical expenses.

With going upmarket the complexity of doing either of these goes up to a level where Pleo becomes a non-feasible solution.

New customers cannot benefit from Pleo without having transferred the money. Many see this requirement as limiting and some feel it goes against their habit of using credit cards.

Insufficient funds in general.

The types of customers (SMBs) we have and attract often have unmet financing needs in their liquidity and face financial challenges. When they do, they often look to banks to get a loan, a line of credit, or credit cards for external funding, but in the process experience either slow and cumbersome credit decisions, lack of transparency, high costs (interest), and poor repayment terms and plans. Even among those who apply, many still experience a financing shortfall as they either receive some or none of the needed financing.

Alternatively, they might go to one of the SMB financing institutions, but this would mean that they add one more actor in their eco-system of financial services. This leads to administrative load and high costs.

Pleo can help our customers with meeting their spend-related financing needs with a far better experience and credit model — by being delightful, fast, simple, flexible, and inexpensive. There’s also an opportunity to meet Pleo’s customers financing needs more precisely, as Pleo has deep insight into their spending patterns and behavior.

With these 2 problem spaces in mind, we explored several solutions, and ideas on what short-term and long-term solutions could work to fix cashflow problems both in companies and in the Pleo wallet.

After several design workshops and story maps We finally settled on an "Overdraft" MVP model which we hoped could help solve the cashflow challenge in the Pleo wallet.

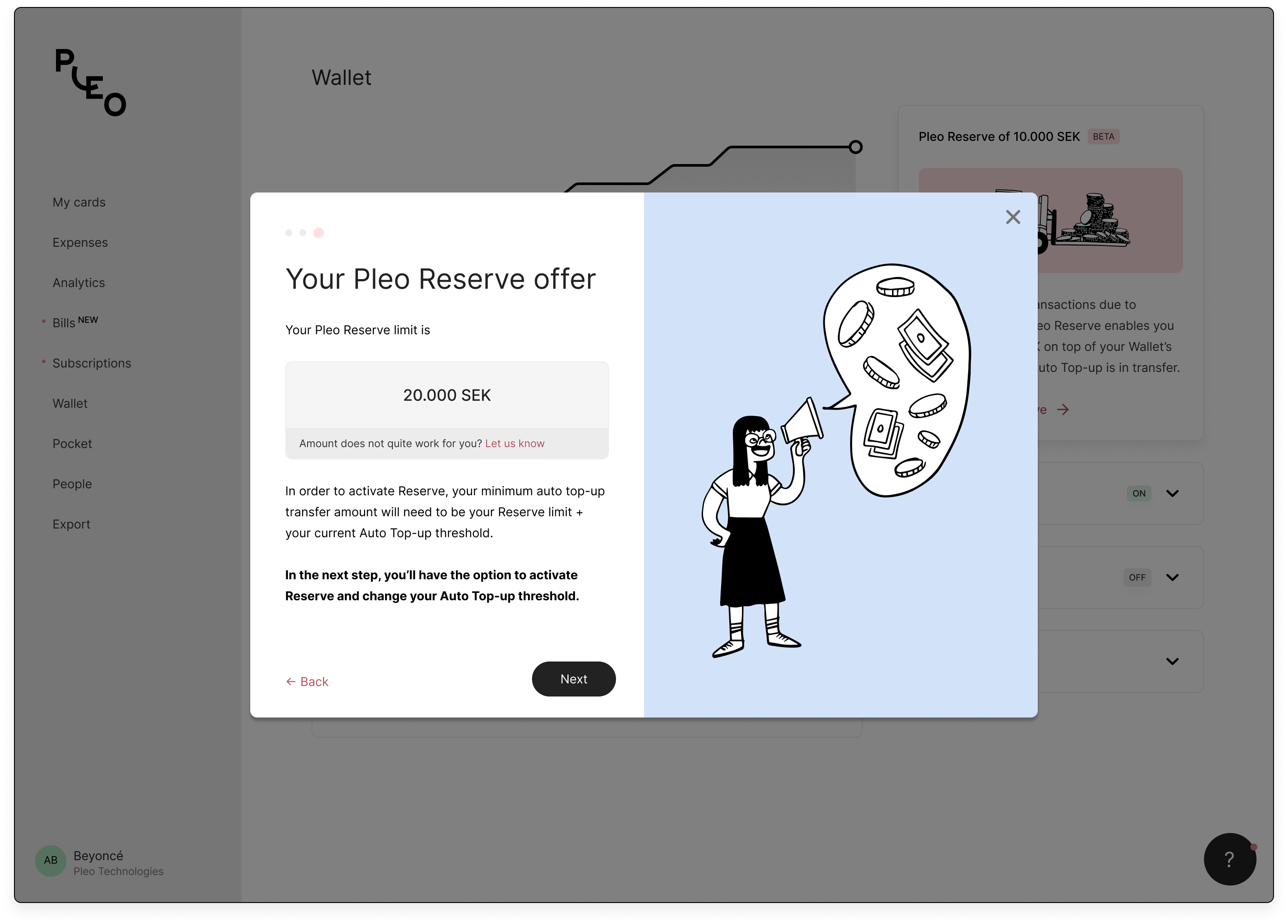

Pleo Reserve - How it works.

For the customers who have auto top-up activated, we'd enable the additional possibility to go into a negative balance.

When an auto top-up threshold is reached, and funds are in transit, employees can continue spending as usual and when the wallet reaches zero, they will be able to go into a negative pre-approved amount.

A couple of days later, an automated repayment would occur using the auto top-up mechanism in place.

This would help employees to experience fewer declined transactions due to insufficient funds in their wallet.

How's it going?

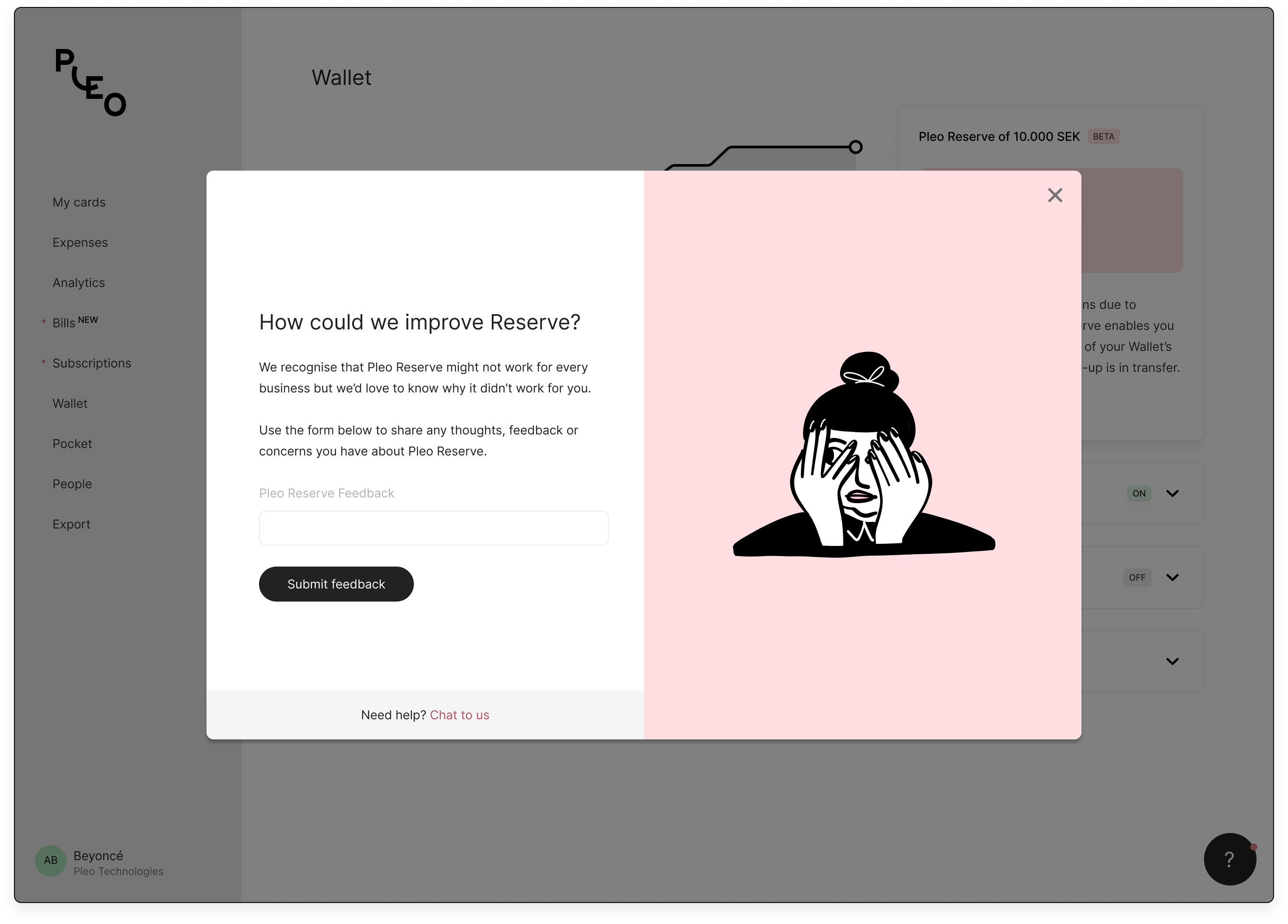

Reserve is currently in Beta across 3 countries and early progress has shown it has helped reduce transaction declines due to insufficient funds in the wallet.

A full rollout is expected in early Q1 to measure the impact across all eligible Pleo companies.